Renault Group:

leader of electric mobility in Europe

Uncontested expertise

The trailblazing Renault Group benefits from a decade’s experience in the design, manufacture, sales and after-sales servicing of electric vehicles. More than 30,000 of the group’s collaborators around the world are trained in the specifics of electric mobility, including the entire European commercial network. Year after year, Renault’s electric vehicles remain the most prevalent on European roads, representing nearly 15% of all 100%-electric vehicles sold in Europe in 2021. On a global scale, more than 490,000 electric vehicles have already been sold by the group.

The most diverse line of electric vehicles

In 2022, Renault launched Megane E-TECH Electric, the first model of its “2.0 generation” of electric vehicles to benefit from the advantages of the Alliance’s CMF-EV platform. It opens a new chapter in the electric revolution launched more than ten years ago.

Connected, integrated into the electric ecosystem but also in the digital ecosystem of its users, Megane E-TECH Electric symbolizes the beginning of the announced reconquest of the compact vehicle segment.

It completes Renault’s well-known 100% electric range, consisting of the versatile ZOE, Twingo E-TECH Electric launched in 2020, the Kangoo E-TECH Electric van, the Master E-TECH Electric van.

In 2021, Dacia unveiled the most affordable vehicle on the market: Spring.

But that’s not all. To allow a wider public to get to know electric driving and to appreciate all of its advantages, Renault Group has an offer to complement its all-electric range. Making use of its unrivalled expertise when it comes to this type of energy, it is launching electrified powertrains on the most popular Renault models: the Clio and Captur E-TECH Hybrid versions which provide up to 80% of urban driving time in electric mode, and the Captur and Mégane E-TECH Plug-in Hybrid versions which travel up to 50 kilometers in electric mode on a mixed cycle (WLTP**). Not forgetting the Renault Arkana E-TECH Hybrid, the first SUV coupe to be produced by a generalist manufacturer. Finally, in 2022, Renault unveiled Austral, its new electrified SUV, which offers various electrification technologies including a new E-TECH Full Hybrid engine.

Renault Group is multiplying the possibilities for zero-emission travel* thanks to its range of electric and electrified vehicles. For several years now, the brand has demonstrated its expertise in hybridization on the Formula 1 track with the E-TECH motor. Moving forward, Alpine will be the first lightweight sports car to offer an all-electric range.

At the heart of new mobility

Electric vehicles have many advantages which not only make them an ideal choice for personal use, but also the perfect vehicle for carsharing. Renault understands this well, as nearly 10,000 of the brand’s electric vehicles are available for carsharing every day in around twenty European cities, either point-to-point with dedicated parking spaces, or free-floating with neither pick-up nor drop-off points like Zity, first introduced in Madrid in 2017 and then Paris in 2020.

To further develop this part of its activities, Renault Group has created Mobilize, a division specialized in mobility, energy and data management services.

Renault Group:

always a step ahead in electric mobility

Continuous innovation

Renault Group was the first to believe in all-electric mobility. Innovation is in its genes, and electric mobility at the heart of its strategy. In order to continually better meet customers’ needs, it is constantly improving its offer with vehicles of increasing range, connected services to facilitate charging and travel, high-tech design, dynamic motors and more. Over the past few years, Renault Group has already launched the second generation of its best-selling utility vehicles Kangoo Z.E. and Master Z.E. as well as the second model of the flagship ZOE.

To prepare for the electric mobility of the future, Renault Group is innovating as part of the Renault-Nissan-Mitsubishi Alliance with the development of the CMF-EV platform (Common Module Family for Electric Vehicles) and a new drivetrain, which benefits Megane E-TECH Electric. Exclusively designed for electric, these native technologies will enable the production of numerous vehicles of different sizes and which serve a variety of purposes.

Renault Group is also involved in the creation of groundbreaking charging systems and connected, even autonomous, driving. The future certainly looks electric!

Renault Group: acting for a virtuous circle

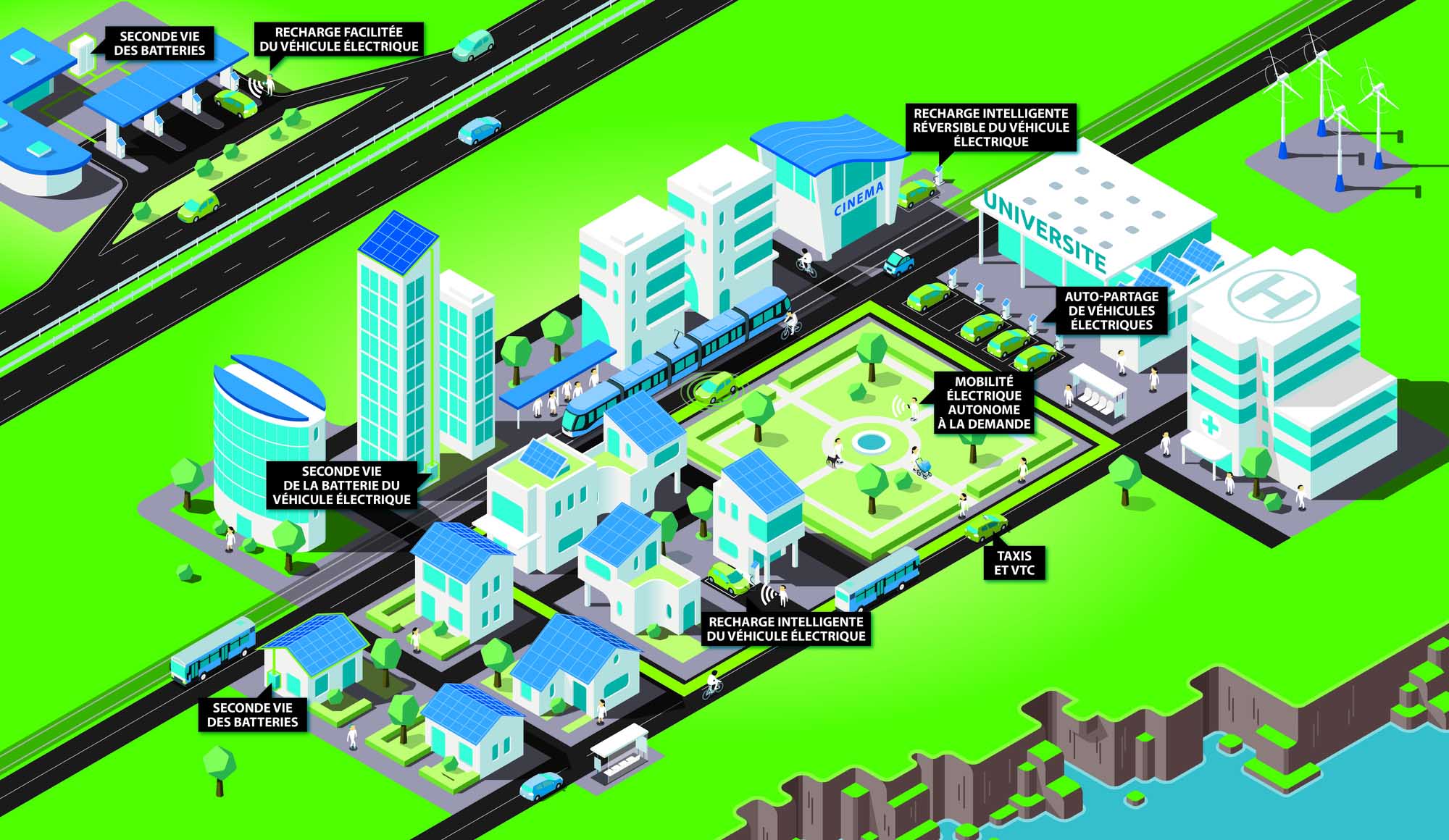

A link in the smart grid

Renewable energies, whose share in the energy mix is constantly increasing, provide electric vehicles with low-carbon electricity. But these sources are often intermittent — like solar or wind power — while energy supply and demand needs to be balanced in real-time. Fortunately, electric vehicle batteries, based in locations all around the territory, can be used for storing energy available at any time. They thus have a key role to play in the equation.

Thanks to the ability to schedule charging and smart charging, Renault Group’s electric vehicles can be recharged at moments when electricity is the most available from the grid, and therefore lowest in carbon. With the development of smart grids, their bidirectional charging can even reinject current back into the grid in cases of strong demand. Lastly, after their first automotive life, Renault’s electric vehicle batteries still perform well enough to serve as storage units, either stationary or to electrify certain modes of transport.

Increasing the variety of roles allocated to batteries and lengthening their life cycle is a way of integrating them fully into the circular economy.

On the way to smart lands

On a neighborhood-, city-, or even island-scale, veritable ecosystems are being developed to intelligently manage travel and energy distribution. Renault Group is at the forefront of this approach. Thanks to its new Mobilizedivision, and numerous partnerships with local authorities, energy engineers, charging operators and even electronic data interchange specialists, Renault Group offers solutions that make the electric vehicle both a device for mobility that is emissions-free when in use, as well as a tool for storing green, locally produced electricity. Examples of these can be found in the eco-district of Utrecht in the Netherlands and on Portugal’s Porto Santo island.

There’s only a small step from infrastructure- and user-related vehicle connectivity, to autonomous driving. Renault Group has experimented with autonomous, electric and shared mobility throughout the Rouen municipality in Normandy and on the Saclay campus in the Paris region.

For Renault Group, electric mobility is at the heart of many promising technological and societal evolutions.

* Zero emissions: neither CO2 nor regulated air pollutants while driving, according to The Worldwide harmonized Light vehicles Test Procedure emission test cycle, excluding wear parts.

** WLTP range, Worldwide Harmonized Light Vehicles Test Procedures (standardized cycle: 57% urban driving, 25% suburban driving, 18% highway driving.)

Copyrights: Jean-Brice Lemal (Planimonteur), Renault Design, Antoine Levesque (Youlovewords), Renault Marketing 3D Commerce, Alex Aristei (Publicis Conseil), CG Watkins (Additive)